Rooted in legacy.

Built to last.

Invest with us and be a part of the growth journey of India’s undiscovered champions. Backed by a proven track record and a rigorous investment process, we are dedicated to delivering long-term value to our investors.

Total Assets Under

Management And Advisory

Management And Advisory

0

Cr

Returns since

inception

inception

0

%

Value of 1₹

invested in mar-21

invested in mar-21

0

x

Alpha vs the benchmark

(S&P 500 TRI)

(S&P 500 TRI)

0

%

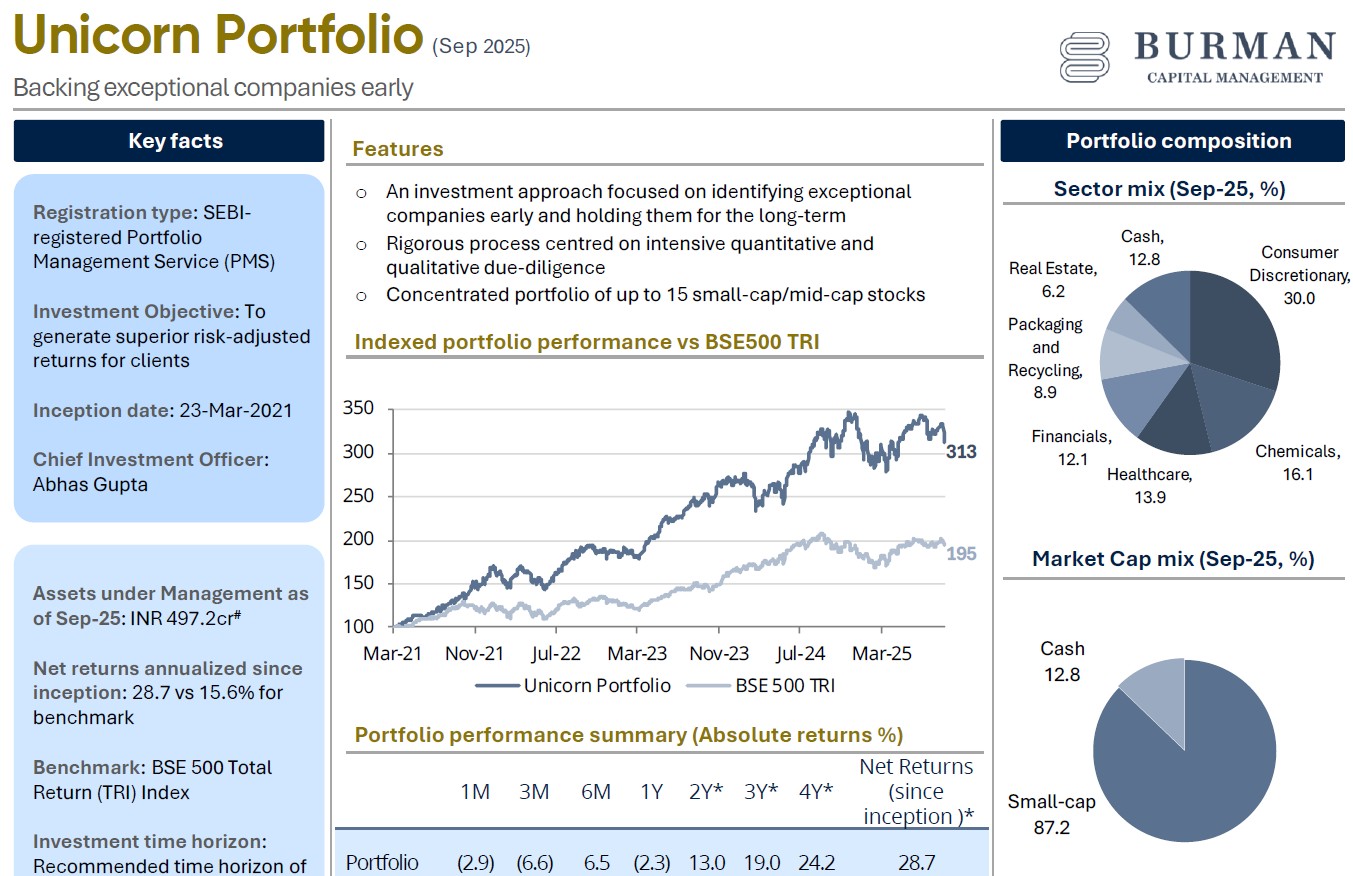

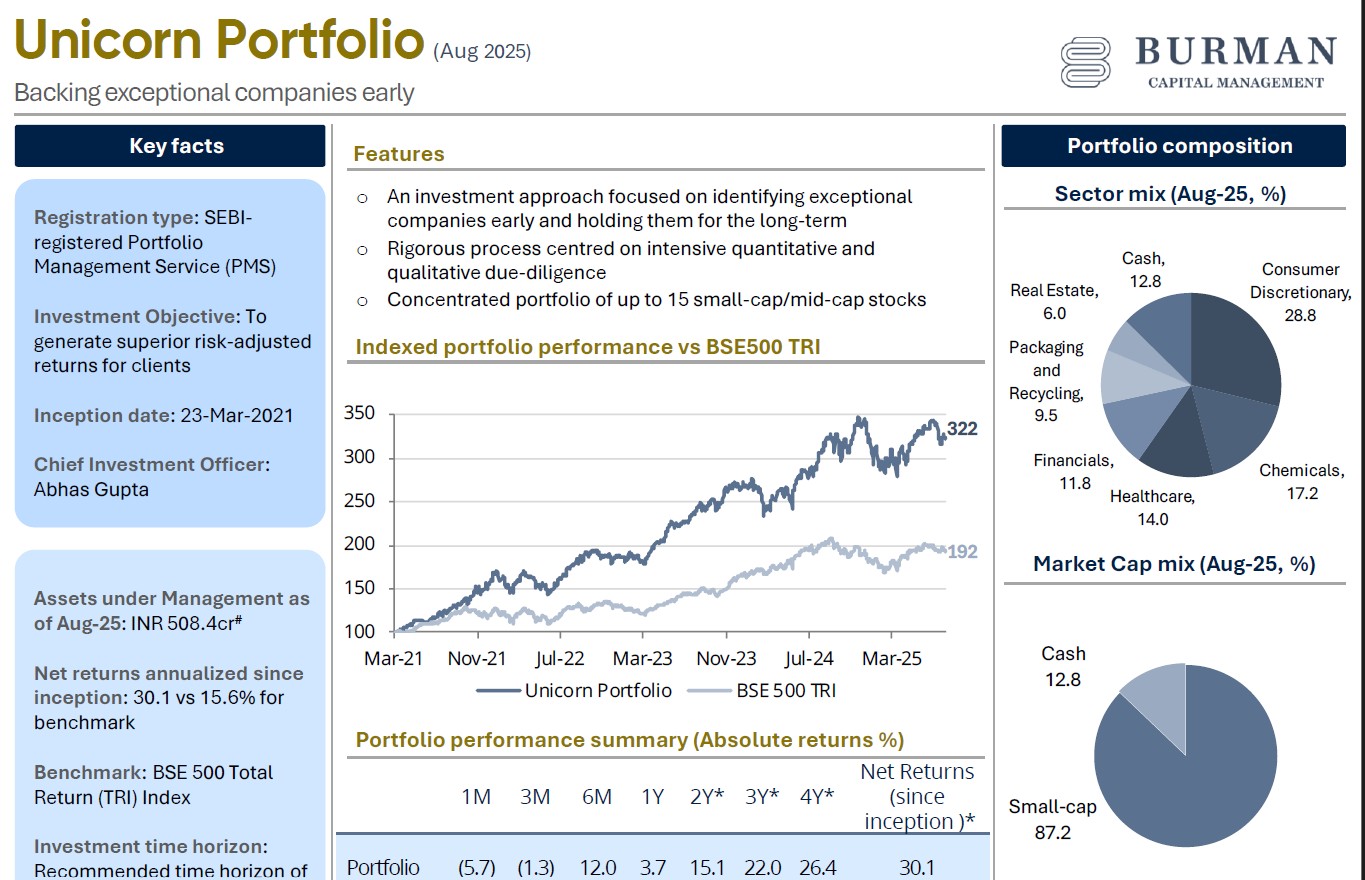

Fact Sheets

Frequently asked questions

Who is a Portfolio Manager?

A Portfolio Manager is a body corporate, which, pursuant to a contract with a client, advises or directs or undertakes on behalf of the client (whether as a discretionary Portfolio Manager or otherwise) the management or administration of a portfolio of securities or funds of the client.

What is Portfolio Management Services (PMS)

Portfolio Management Service (PMS) is a professional financial service where skilled portfolio managers and stock market professionals manage client portfolios with the assistance of a research team.

What is the minimum amount for investing in Portfolio Management Services?

As per SEBI PMS regulations, the minimum ticket size investment criteria is Rs. 50 lakhs. Clients can make such investments through both funds and/or securities.

What are the different types of Portfolio Management Services (PMS) available for an investor?

PMS offers three (3) types of services:

– Discretionary Services: The Portfolio Manager individually and independently manages the funds and securities of each client.

– Non-discretionary Services: The Portfolio Manager manages the funds in accordance with the directions of the client.

– Advisory Services: The Portfolio Manager recommends investment ideas. The execution of the same rests solely with the client.

– Discretionary Services: The Portfolio Manager individually and independently manages the funds and securities of each client.

– Non-discretionary Services: The Portfolio Manager manages the funds in accordance with the directions of the client.

– Advisory Services: The Portfolio Manager recommends investment ideas. The execution of the same rests solely with the client.

Who can invest in PMS?

Following investors can invest through PMS:

• Resident Individuals

• Hindu Undivided Family (HUF)

• Body Corporates

• Non-Resident Individual

• Partnership Firms

• Limited Liability Partnership

• Any other eligible investor

• Resident Individuals

• Hindu Undivided Family (HUF)

• Body Corporates

• Non-Resident Individual

• Partnership Firms

• Limited Liability Partnership

• Any other eligible investor

Is Partial Withdrawal of Portfolio Permitted, for the existing clients of Portfolio Managers?

The client may withdraw partial amounts from his portfolio, in accordance with the terms of the agreement between the client and the Portfolio Manager. However, the value of investment in the portfolio after such withdrawal shall not be less than the applicable minimum investment amount.

Can we invest directly?

Yes, any investor/client contributing a capital of Rs 50 Lakh or more can invest.

Can a portfolio Manager impose a lock-in on the investor?

Portfolio managers cannot impose a lock-in on the investment of their clients.

Can a Portfolio Manager offer indicative or guaranteed returns?

Portfolio manager cannot offer/ promise indicative or guaranteed returns to clients.

What is the tax treatment in PMS investment?

For PMS investors, the taxation framework is akin to the taxation of capital gains unlike mutual funds, which enjoy the benefit of Section 10(23D) of the Income Tax Act as a pass-through entity and are not subjected to taxation, PMS transactions are executed directly from the client’s Demat account. The investor should consult his/her tax advisor for the same.

Can I specify stocks/ sectors that I want or don’t want to hold?

In our discretionary portfolio management service, the discretion to invest primarily lies with the portfolio manager. However, at the time of onboarding investors need to disclose all lists of restricted securities where they may have access to unpublished price-sensitive information or where the client doesn’t want to invest.

Can I book my profits partially any time?

Yes, however, the value of investment in the portfolio after such withdrawal shall not be less than the applicable minimum investment amount.

Can we add/delete holder in PMS?

No holders cannot be added or deleted

What fees can a portfolio manager charge from its clients for the services rendered by him?

For the services rendered, portfolio managers charge three types of fees – fixed amount, performance-based fees or combination of both.

How can I monitor the performance of my portfolio?

You will be provided online access to view details of your account. The portfolio Manager shall also be sharing monthly and quarterly reports with the clients.

How can we open a PMS account with Burman Capital Management Pvt. Ltd.?

Client can directly contact us at support@burmancapital.com. Our representative will contact you and guide you through our onboarding process.

Can existing client update/change contact details/Address in PMS records post Activation?

Yes, you can update / change your details post activation

Can we change nominee in PMS account?

Yes, client can change nominee in PMS account by filling the requisite documents.

Can an NRI invest in PMS?

Yes, an NRI can invest in the PMS through their NRE or NRO accounts. There are additional compliance/documentation requirements for NRI clients.

What kind of return can I expect?

Portfolio Management Service offer various products to suit individual investment objectives. We endeavor to provide superior risk-adjusted returns to investors but the same cannot be guaranteed. Future returns may vary based on market and idiosyncratic risks. Clients are requested to read the disclosure document carefully before investing.

Where can investors file their complaints?

Investors can lodge their complaint in score portal – https://scores.gov.in

Why should an investor select PMS over MF?

The differentiating factor is PMS’ customized approach. Portfolio Managers understand each customer’s needs and prepare a model portfolio depending upon his or her financial goals, time horizon and investment outlook.

Can a person open a joint account?

Yes, joint accounts can be opened.