Concentrated bets

When I’ve looked at all the investors (that) have very large reputations — Warren Buffett, Carl Icahn, George Soros — they all only have one thing in common. And it’s the exact opposite of what they teach in a business school. It is to make large concentrated bets where they have a lot of conviction.

Stanley Druckenmiller

We believe in making high-conviction bets where our process demonstrates asymmetrically higher reward per unit of risk taken

Unlike the popularly accepted notion that diversification drives risk, our belief is that the quality of portfolio companies drives risk rather than the quantity of companies in a portfolio.

In fact, our view is that building concentrated portfolios reduces risk as the fund manager’s focus is on relatively lesser positions and hence can react better relative to other market participants when the story changes. For details on our framework for selecting companies, please click here

In fact, our view is that building concentrated portfolios reduces risk as the fund manager’s focus is on relatively lesser positions and hence can react better relative to other market participants when the story changes. For details on our framework for selecting companies, please click here

What we do

• Bottom-up stock picking

• High conviction bets

• Investments in focused sectors

• High conviction bets

• Investments in focused sectors

What we don’t

• Benchmark hugging

• Under-weight/overweight

• Broad-brush representation across sectors

• Under-weight/overweight

• Broad-brush representation across sectors

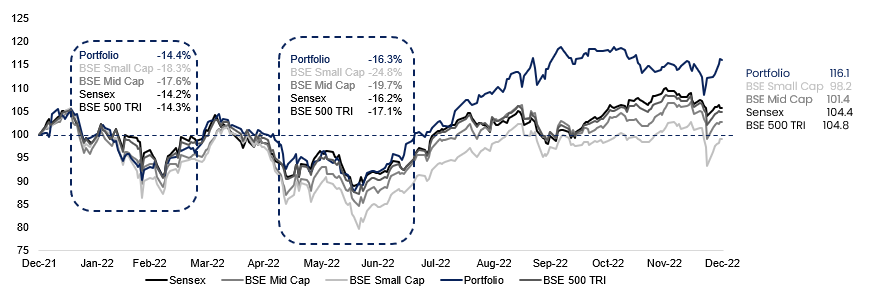

Concentrated portfolios ≠ higher volatility

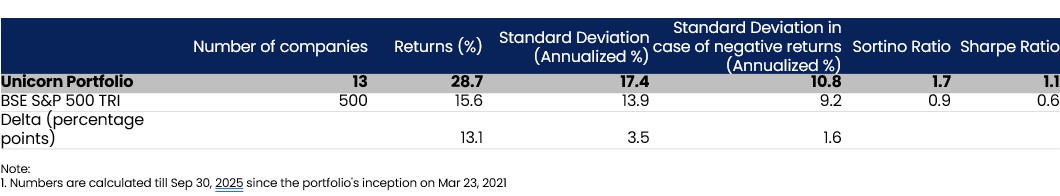

Since inception, our portfolio’s volatility (having <15 companies) is not significantly different from our benchmark that has 500+ companies as shown below

Since inception, our portfolio’s volatility (having <15 companies) is not significantly different from our benchmark that has 500+ companies as shown below

In a volatile CY2022, our drawdowns were lesser than headline indices while bounce-backs were stronger