Summary

CY23 was a good year for Indian equity markets as local developments such as strong corporate earnings, expectations of easing interest rates, higher confidence in political continuity aligned well with positive global factors including soft landing expectations, US fed rate cut expectations in CY2024, among others. As a result, between Apr 1, 2023, to Dec 31, 2023, Indian large-caps, mid-caps, and small-caps (defined on Pg3) have delivered 28%, 54% and 69% returns respectively.

Sentiments played a large part in driving these returns, our estimate is that for the three categories, between 36% to 78% of the returns were driven by TTM (trailing twelve months) P/E re-rating. As a result, valuations that looked reasonable to premium (16X to 30X median TTM P/E) at the start of the financial year have become expensive in general (26X to 42X median TTM P/E) and frothy in pockets (50X to 75X median TTM P/E). Median TTM P/E multiples for all industries/categories are at or close to all-time high levels.

From the time of our newsletter in Jul-22, titled “Time to start investing selectively”, the three categories have delivered up to 89% returns. We now think, it is “Time to reassess portfolios”. We believe that Indian corporates are going to do extremely well over the next few decades and that there is disproportionate wealth to be made in India over the long-term. However, this may be a good time to look deeper at each individual portfolio company and differentiate returns made on merit vs. hype. Perhaps, also to exit laggards and companies with excessive valuations.

Portfolio performance update

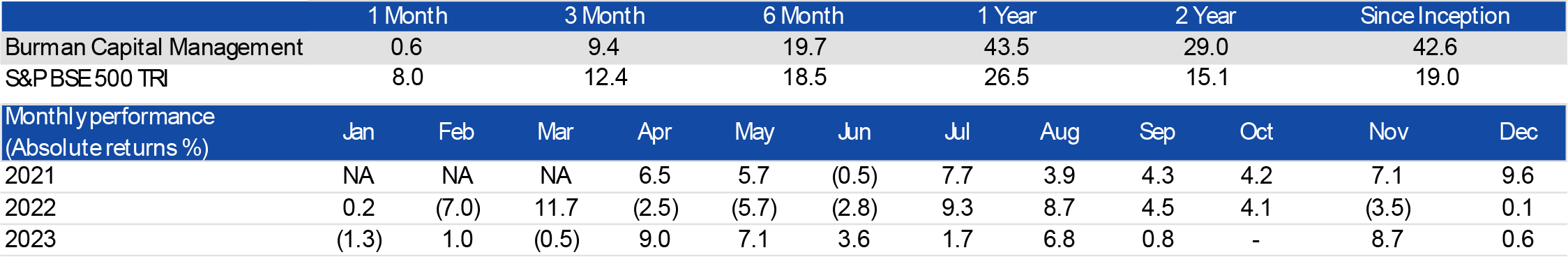

The strong bull-run since the start of the financial year continued into the Dec-23 quarter with S&P BSE SENSEX, BSE Midcap and BSE Smallcap indices delivering 9.7%, 13.9% and 13.6% respectively. Our portfolio reported returns of 9.4% vs. 12.4% for our benchmark S&P BSE 500. Since inception i.e. Mar 23, 2021, our portfolio has delivered annualized returns of 42.6% vs. S&P BSE 500 returns of 19.0%, delivering outperformance of close to 2,360 bps. Over the last twelve months, our portfolio has delivered 43.5% returns vs. 26.5% for our benchmark.

Performance Snapshot

Note: All returns are net of fees and expenses (TWRR). Since inception and two year returns are annualized; other time period returns are absolute. Benchmark changed effective from 1st April 2023 to S&P BSE 500 TRI from S&P BSE Small Cap Index, according to SEBI circular dated December 16, 2022.

Strong performance across market-cap categories

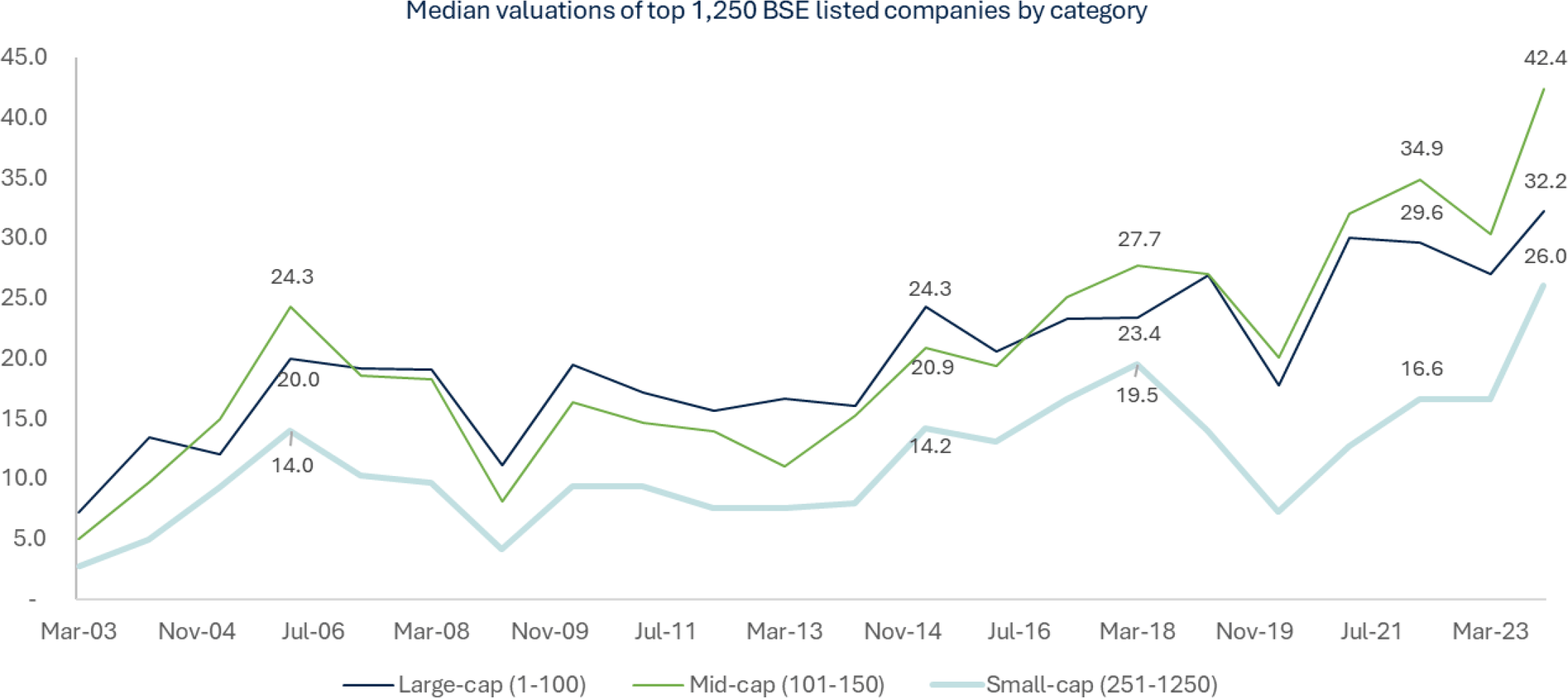

In the analysis that follows, we have defined ‘Large-caps’ as the top 100 companies in India in terms of market capitalization at the start of each financial year. ‘Mid-caps’ as the next 150 companies and ‘Small-caps’ as the following 1,000 companies. Hence, a total of 1,250 companies have been analyzed for each financial year since the year 2003.

Since Apr 1, 2023, large-caps have delivered 28% returns, mid-caps 54% returns and small-caps 69% returns. As a result, median Price / TTM Earnings for the three categories have reached 32X, 42X and 26X. According to our calculations, these are the highest numbers recorded for the categories in the last twenty years as shown in the chart below. Small-caps, while higher than historical valuations, are still at a discount to mid-cap and large-caps, although the discount has been reduced compared to the past.

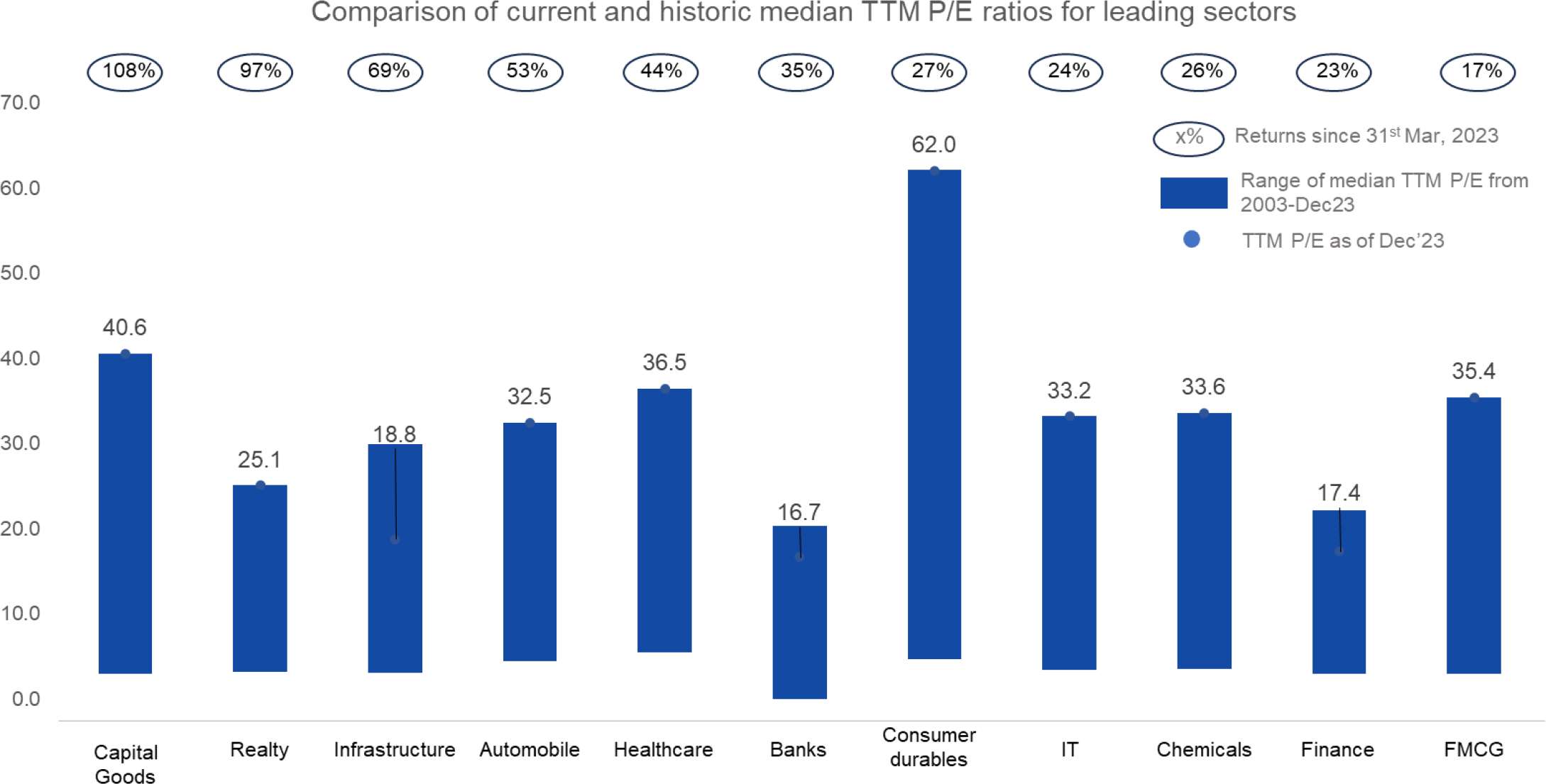

All-time high valuation across sectors

The chart below shows valuations of key sectors after the current rally compared to their median valuation range over the last 20 years.

In all industries except financial services the current median TTM P/E ratio is at a 20-yr high. Even in financial services it is close to all-time highs. In some industries such as Consumer Durables, Capital Goods, Healthcare and FMCG median TTM P/E is more than 35X.

Capital goods (108%), Real Estate (97%), Infrastructure (69%), among others have delivered returns which have far outstripped their earnings growth largely driven by large order book, project announcements or capex announcements. Lofty expectations in these industries, if not backed by commensurate earnings/cash flow can lead to significant capital losses.

Public sector undertaking (PSU) as a group has also performed exceptionally well. Basket of 93 PSU companies have delivered 67% returns since Apr 1, 2023.

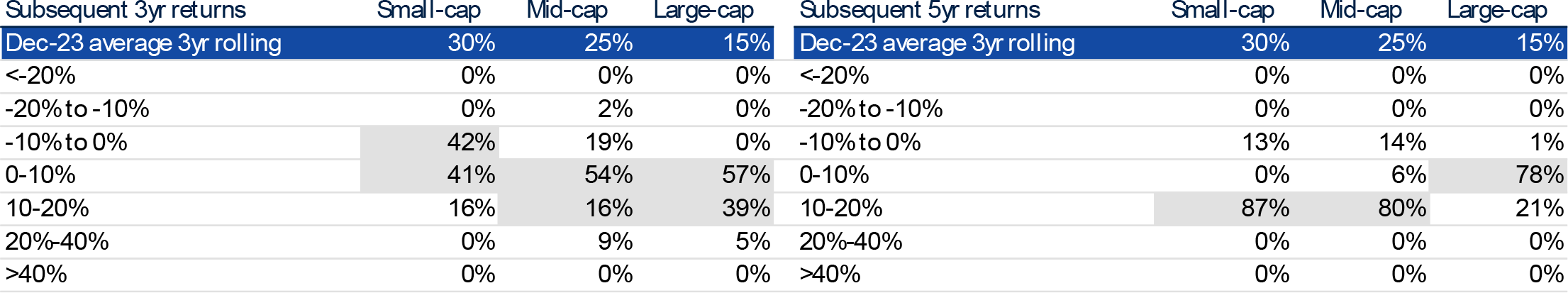

Small and mid-caps have delivered strong returns in the past three years, return expectations going forward should be moderated

Last three years have been strong for Indian markets especially for small- and mid-caps. The average 3-year rolling returns for BSE SENSEX, BSE Mid-cap and BSE Small-cap in Dec-23 were 33%, 27% and 15% respectively. History suggests that when 3-yr rolling returns reach such levels (> 30%/>25%/>15% respectively for the three indices), the following 3-yr return expectations need to be tempered. Although, 5-yr

returns end-up being in-line with long-term averages.

What this means from an investing standpoint

Entry valuation is an important driver of future equity returns although it is not the only driver. Moreover, there are shortcomings of using TTM P/E as a valuation benchmark. Having said that, the analysis above should provide a general sense that equity valuations are high vs history and hence return expectations should be tempered. Although high valuation does not necessarily imply a correction is in the offing, in such times vulnerability to external surprises increases.

We are using this time to assess if structural issues are emerging in any of our portfolio companies, especially where valuations are rich. We are also focusing on identifying opportunities in sectors that offer value such as chemicals, energy, among others or where there is a fundamental shift happening in terms of long-term value creation.