Summary

Burman Capital Management completed three years of managing money under the SEBI PMS license in March 2024. We are lucky that our first three years have been in an environment where India’s economic prowess, global stature and most importantly, self-confidence is hitting new highs. Since inception we have delivered 36.5% annualized returns vs our benchmark returns of 19.6% annualized. It has been an

extraordinary beginning to a long journey of wealth creation we hope to embark on!

In this newsletter, we review how our strategy has worked since inception and discuss certain important characteristics of our portfolio that are essential for current and prospective investors to understand. We also discuss key learnings we have picked-up along the way.

Lastly, we discuss how the current investing environment is shaping up in our view and our approach to investing.

Portfolio performance update

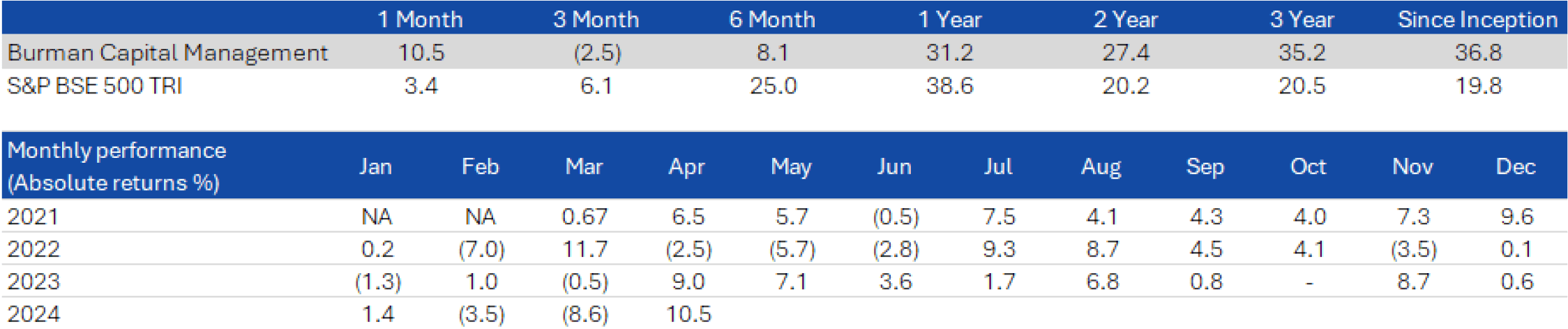

Since inception i.e., Mar 23, 2021, our portfolio has delivered annualized returns of 36.8% vs. S&P BSE 500 TRI returns of 19.8%, delivering outperformance of 1,700 bps annualized. Over the last three years, our returns have been 35.2% vs 20.5% for our benchmark, an outperformance of close to 1,500 bps. Over the last two years, annualized returns have been 27.4% vs 20.2% for our benchmark.

Year to date, i.e., from Jan-Apr’24, our portfolio is down 1.1%. The muted number was driven by a sharp drawdown our portfolio witnessed in Mar-24 driven by SEBI’s stress test directive to small cap mutual funds which created a temporary shock in small-caps. A large part of the drawdown was reversed in April. We expect strong earnings momentum in our portfolio companies going forward.

Performance Snapshot

Note: All returns are net of fees and expenses (TWRR). Since inception and two year returns are annualized; other time period returns are absolute. Benchmark changed effective from 1st April 2023 to S&P BSE 500 TRI from S&P BSE Small Cap Index, according to SEBI circular dated December 16, 2022.

Performance review and discussion on certain portfolio characteristics

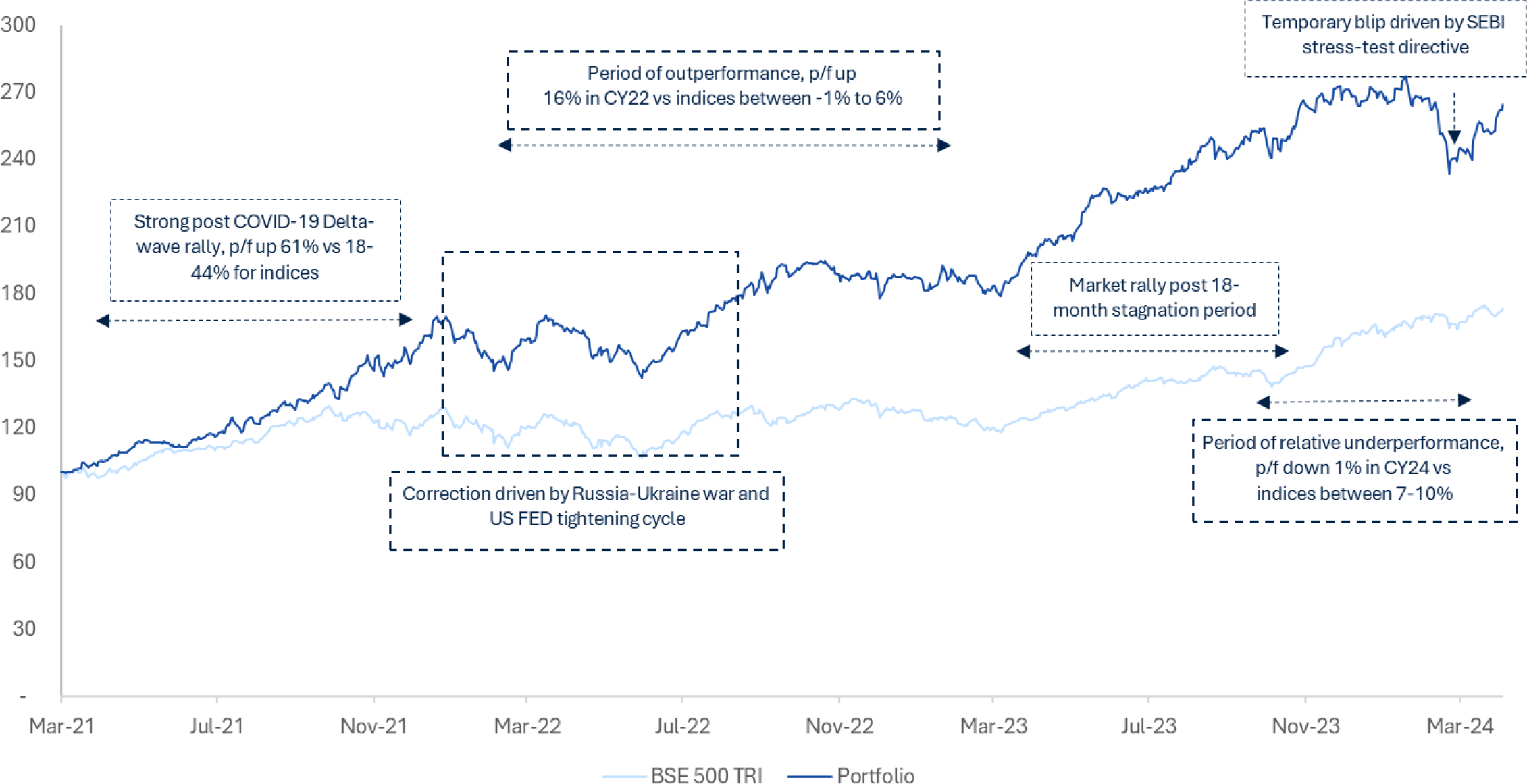

Over the last three years, we have comfortably beaten our benchmark, 2.6X returns delivered by our portfolio vs 1.7X returns for our benchmark. However, our portfolio saw periods of both underperformance and outperformance in between. These periods of underperformance or outperformance should be viewed as a feature of our investment strategy given our absolute-return focus rather than benchmark-linkage.

We build concentrated portfolios with up to fifteen companies vs our benchmark (benchmark chosen as per SEBI circular dated December 16, 2022) which has 501 companies. As may be obvious, our portfolio’s correlation to our benchmark is not very high at 0.6. In fact, our ortfolio’s correlation with some other indices, especially BSE SENSEX, is also not significant. Lack of correlation because of our concentrated portfolio construction strategy is a conscious choice and investors should have expectations accordingly i.e., we may

do well in certain periods when our benchmark does not do well, for instance CY2022 or we may not do well when our benchmark does e.g., Jan-Apr 2024.

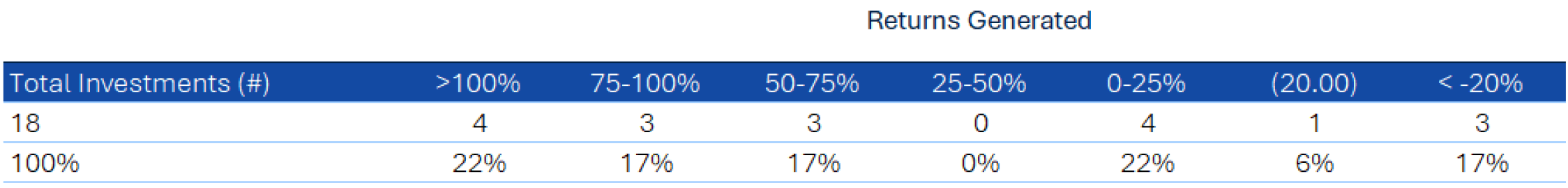

Our success rate has been good to date, as evidenced in the table below. Out of the 18 companies we have invested in thus far, 10 have delivered >50% returns (4 above 100% of which 2 above 250%). Moreover, there are two companies in the 0-20% bracket which are new investments and are yet to hit the J-curve in our assessment, we expect some of them to hit the >100% category if our thesis plays out.

Churn-rate has been low, we have exited six out of eighteen companies invested in the last three years. One of the companies was acquired by a competitor, two met our investment thesis/targets well ahead of time so we exited, one we have parked for now to relook later and the remaining two were mistakes that we corrected. The biggest positive however is qualitative i.e., we have been true to the thesis we started with and have not diluted our process to make a quick buck.

Key learnings

We have made two investing mistakes in the last three years. In the first investment we failed to identify an important blind spot early and in the second we continued backing a management which had failed to execute in an environment of increasing competitive intensity. We have discussed these in past newsletters in detail (links: Company 1 and Company 2). However, the bigger mistakes have been, as Warren Buffet puts it, “errors of omission rather than commission.”

Over the last few years, there has been a significant shift in the country’s profit pools from companies that benefited in the preceding decade i.e., from consumer staples and financial services to companies linked to capital formation in the country including power/energy, manufacturing, capital goods, infrastructure, among others. We missed several fundamentally strong companies that are harnessing a decadal opportunity in these sectors.

Two key learnings follow – (1.) keep an eye on macros: while we are and will be bottom-up fundamental equity investors, at times shift in macros have severe investment implications, identifying companies that fit our investment framework and undergoing structural macro shifts can be highly rewarding and (2.) eliminate behavioral biases or ‘tags’ when looking at companies for instance PSUs are not well run or capital goods companies have lumpy earnings profile, among others. There are always exceptions to the norm and often money is made when there are ‘perception-reality’ gaps.

At times, our process has not allowed us to take bets on companies that we otherwise thought could generate attractive returns. While in the short term this may look like a limitation, in the long term we except this discipline to drive superior outcomes for us.

Looking ahead

As we pointed out in our newsletter (Time to reassess portfolios), stocks are trading at record valuation levels on trailing earnings multiple basis. Consensus is that we are in an upcycle of corporate profitability and these multiples are more benign if one looks at 1-yr and 2-yr forecasts. If corporate profitability assumptions do not come through or if there are global shocks, there can be significant volatility in the short-term. Irrespective, our view is that return expectations should be moderated going forward. We are positioning our portfolio towards companies with strong competitive advantages and where there is significant earnings visibility. We remain optimistic about the wealth generation opportunities India has to offer over the long-term.