Summary

The last fourteen months have been a tough period in Indian equity markets especially at the small-cap end of the spectrum – the BSE Small Cap index is still down 10% from its peak in Sep-24. While our portfolio had been resilient over a large part of this period (0.6% returns from Sep 24 to Aug 25 vs -6.7% for our benchmark BSE 500 TRI and -9.9% for BSE Smallcap), the last three months have seen a significant drawdown.

There are two reasons for the same – (1.) general sentiment on small-caps especially below Rs100 bn of market capitalization (our core focus area) has been weak and (2.) Multiple unexpected headwinds hit four of our portfolio companies in a short period of time – a first of its kind instance in the last four and a half years since we started the strategy.

In this newsletter, we discuss the four companies that are facing headwinds and discuss our portfolio actions with respect to each. We have also used this time to add three new positions and are slowly ramping those up.

Portfolio performance update

Over the last month, our portfolio delivered returns of -4.6% vs 1.0% for our benchmark S&P BSE 500 TRI. BSE Smallcap delivered returns of -3.4% during the same period. Since inception i.e. Mar 23, 2021, our portfolio has delivered annualized returns of 25.8% vs. S&P BSE 500 TRI returns of 16.2%, delivering outperformance of more than 950 bps annualized.

Over the last four years, our returns have been 18.9% vs 14.1% annualized for our benchmark, an outperformance of close to 480 bps annualized. In the last twelve months, our portfolio has delivered -10.2% vs 5.6% for our benchmark.

Performance Snapshot

Note: All returns are net of fees and expenses (TWRR). Since inception, two-year and three-year returns are annualized; other time period returns are absolute. Benchmark changed effective from 1st April 2023 to S&P BSE 500 TRI from S&P BSE Small Cap Index, according to SEBI circular dated December 16, 2022.

Market-cap biased correction

Since Indian indices peaked in Sep 2024, returns have been significantly market-cap biased. While BSE

Sensex touched all-time high recently, the BSE small cap and the Nifty Microcap index are still down 10% and 13% from their 52-week high. This follows an exceptionally strong period for these indices from Mar 2023 to Sep 2024.

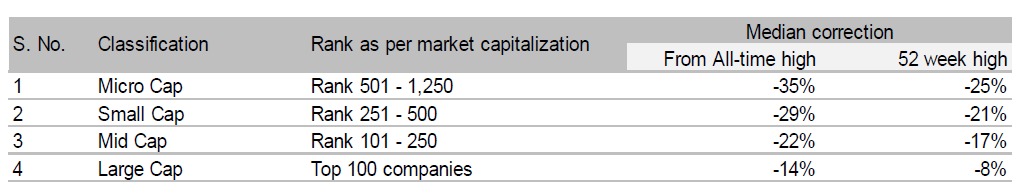

Logically, stock-level drawdowns are highly market cap-biased as shown below.

As per AMFI (Association of Mutual Funds in India) definition, stocks with market cap rank of less than 250 are classified as small caps. But even within small-caps, the ‘micro’ small-caps (Rank 501-1,250) have suffered more with median correction of 27% and 37% from 52-week highs and all-time highs,

respectively.

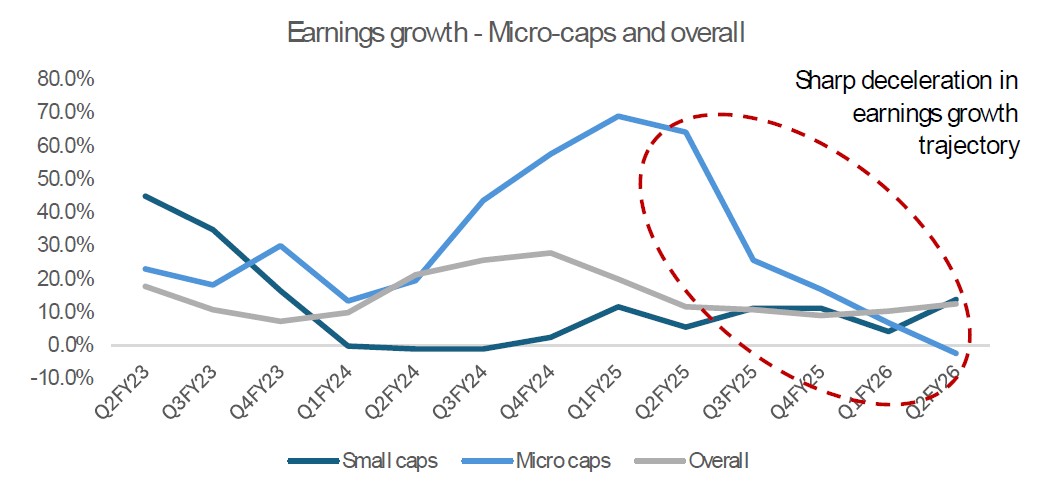

The correction is driven by the fact that earnings in this part of the market have contracted quite

significantly as India’s nominal GDP growth slowed down in the last few quarters to less than 9%.

Slowdown in economic activity impact earnings of small and micro-cap companies more acutely.

There is widespread anticipation that nominal GDP growth is close to bottoming-out. The next phase of

growth upcycle is likely to be driven by government and regulatory actions such as Income tax cuts, GST

rate rationalization, interest rate reduction, and income transfers at the state-level. As and when nominal GDP growth starts picking up, the micro and small-cap end of the spectrum is likely to experience the maximum delta in earnings.

Portfolio headwinds

Four important companies in our portfolio faced unexpected business headwinds in the last two months which led to a sharp drawdown in our portfolio performance, below we discuss the four in detail.

A leading Pharma API and intermediates manufacturer

We invested in this company about two and a half years back, the company’s stock has been one of the best performing in our portfolio – up 2.5x from the time we started investing. Our initial thesis has only become stronger given the accelerated pace at which the company’s CDMO division is growing. However, in Q2 the company reported an unexpected decline in EBITDA, the first such instance since we invested. The reason for the decline was delays/deferment of API purchases by the company’s customers in Europe resulting in – (1.) revenue loss and (2.) sharp margin erosion due to high fixed cost nature of the business.

The company’s share price is down almost 20% from the result announcement date and 30% from its 52-week high. Given the weakness in their API division (which is expected to continue) and the fact that there are two large facilities coming on stream in the next two quarters, reported numbers may continue to look weak because of upfronting of costs and gradual sales ramp-up. Hence, while we like the long-term story, we have taken an allocation cut for now given near-term business uncertainty and will re-assess position sizing in one to two quarters basis facility ramp-up.

A global chemicals leader

Driven by a change in the competitive structure of the industry concerned wherein the second largest global player had filed for bankruptcy last year, we had taken a position in this company more than a year back. After our investment, the company acquired the bankrupt leader, and we increased our allocation to the company. Initial numbers reported by the company showed that the acquisition was progressing better than expected and the management gave very encouraging forward guidance – as a result the stock rallied more than 50% in less than a year from our purchase.

However, in their September earnings call, management pointed out unexpected softness in the acquired business due to excess inventory build-up at their customers end and subsequently in their November presentation reduced guidance. As a result, the stock has come off 35% from its peak. While the company’s current valuation is attractive, near-term uncertainty with respect to the turnaround of the asset has put pressure on the stock price. We realized this issue in September and have cut our position by more than half over the last few months. Will wait for further clarity on integration process and make appropriate decisions in the next couple of months.

An affordable home financier

We invested in this affordable home financier almost three and a half years back. In our assessment, this company has been the most well-run listed company in the space delivering consistent results quarter after quarter and has delivered good returns for us. In its Q1 results, they had reported stress in early buckets but had pointed out that the same was transient and they had already started seeing improvement. However, in their Q2 results, the stress increased due to increasing pressure in three important cities for them including Surat, Tirupur and Coimbatore – all impacted due to the US President’s reciprocal tariffs that have hit the Gems and Jewelry and Textile industry hard in the respective cities.

The management also refrained from giving forward guidance and said that they will work hard over the next couple of months and come back with a revised view after Q3. Given the uncertainty the stock has corrected more than 25% from its peak. We have cut our allocation to this position and will monitor progress to take further action if required. Here again, the long-term story is intact but the short-term is hazy.

A leading Indian recycler

In alignment with the Government of India’s strategic imperatives to curb plastic pollution, the Plastic Waste Management (PWM) Rules have been systematically enacted and phased in over the past five years. A key recent development is the mandate, effective April 1, 2025, introducing a minimum requirement of 30% recycled Polyethylene Terephthalate (rPET) content for all PET bottles. This policy shift has effectively catalyzed a significant, high-growth market opportunity for certified rPET producers. We invested in the player with the largest rPET capacity and the largest source of PET bottles in the country (a key competitive differentiator, in our view).

Unfortunately, while the regulation holds, a relaxation was provided on Jun 3, 2025 by the MoEFCC (Ministry of Environment Forest and Climate Change) wherein producers of PET bottle can defer their first- year obligation to the next three years given rPET capacity constraints in the industry. This relaxation led to rPET buyers deferring their purchases and as a result demand has collapsed while supply has come on stream leading to under-utilization of existing facilities and pricing pressure.

Because of this pressure and due to temporary increase in bottle prices, our investee company reported a dismal operating performance reporting a PAT loss for the first time since COVID-19 Delta wave impacted Q1FY22. We understand that the ministry is reviewing its position and will release a final notification soon. We are hopeful that the final notification will move the industry to increase their adoption of rPET benefiting the company significantly. We have not made any changes to this position.

Summary

We believe that the last three months have been an atypical period for us when weak sentiment on the small-cap space combined with unexpected short-term headwinds in four important portfolio companies (peak contribution of 35%+ of the portfolio) have resulted in our weakest returns since inception. We believe we have taken corrective actions for now and will continue to monitor the situation very closely.

We have also used this time to build positions in three new companies. These new positions are in areas where we think there is a long runway for growth and are companies backed by exceptional management teams.

We believe we now have a more balanced portfolio positioning and hope to have better news for you next time we write to you. In case you would like to discuss this in more detail, please feel free to write to me on agupta@burmancapital.com.

About Burman Capital Management

Burman Capital Management is a part of Burman Family Holdings, the strategic investment platform of the Burman Family, which over the last twenty years has invested over US $500 million in various businesses primarily in India and have partnered and joint ventured with many of the leading Fortune 100 companies from around the world. The Burman family are the control shareholders of the Dabur Group. Dabur was founded in 1884 by Dr. S.K. Burman and is today one of the largest Indian Fast Moving Consumer Good Company in India with over US$1 billion in revenue and a market capitalization of over US$10 billion.

At Burman Capital Management, we are long-term investors with deep passion for identifying and investing in exceptional businesses early. We are fundamentals-driven bottom-up investors and run concentrated portfolios focusing on small to mid-size companies. We are a SEBI-registered Portfolio Manager with registration number INP100007091.

Disclaimer

The information contained herein is strictly confidential and meant solely for the use of authorized recipient only. If you have received this report by mistake or are not the intended recipient, please notify the company immediately and destroy this report. The information contained in this report does not construe to be any investment, legal or taxation advice to the recipient. It is only for private circulation and use. While care has been taken by the Company to ensure completeness of the information in this report, as the report is system generated it has not been independently verified and no guarantee expressed or implied is made as to its accuracy. The company shall not be liable for accuracy of the information contained herein with respect to the recipient of this report and disclaim any and all liability as to the information set forth herein or omissions here from, including, without limitation, any express or implied representation or warranty with respect to such information. Performance related information provided in this report and investment approach provided hereunder has not been verified by SEBI or any other regulatory authority. No action shall be solicited on the basis of the contents of the information provided. Please note that past performance of the financial products, instruments and the portfolio does not necessarily indicate the future prospects and performance thereof. Such past performance may or may not be sustained in future. Company investment decisions may not be always profitable, as actual market movements may be at variance with anticipated trends. Investments in securities are subject to market risks and other risks and there is no assurance or guarantee that the objectives of the company will be achieved. Please read the Disclosure Document carefully before investing. Performance relative to other Portfolio Managers within the selected Strategy: Click here. Neither company nor any of its affiliates, associates, representatives, directors, or employees shall be responsible for any loss or damage that may arise to any person due to any action taken on the basis of this report. Risk factors associated with the investment approach have been provided under the Disclosure Document that can be referred to at www.burmancapital.com.

For direct On-boarding, please write to us on: clientservicing@burmancapital.com