Non-linear Outcomes

Our focus is on generating disproportionate

outcomes by investing in opportunities that

offer asymmetric reward per unit of risk taken

Unlocking Non-linear outcomes

through small and mid caps

97% of companies delivering over 10X returns in 10 years were from small and mid cap space.

Based on study conducted by us on top 1,250 listed companies by market cap across eleven rolling 10-year periods from 2004-24

- Our research and experience suggests that a fertile ground to achieve the disproportionate outcome is the small and mid cap space, where several fundamentally strong companies are largely undiscovered or misunderstood.

- Our strategy is to identify and back these exceptional companies early, before their potential is fully recognized by the market.

The DNA of 10X

companies

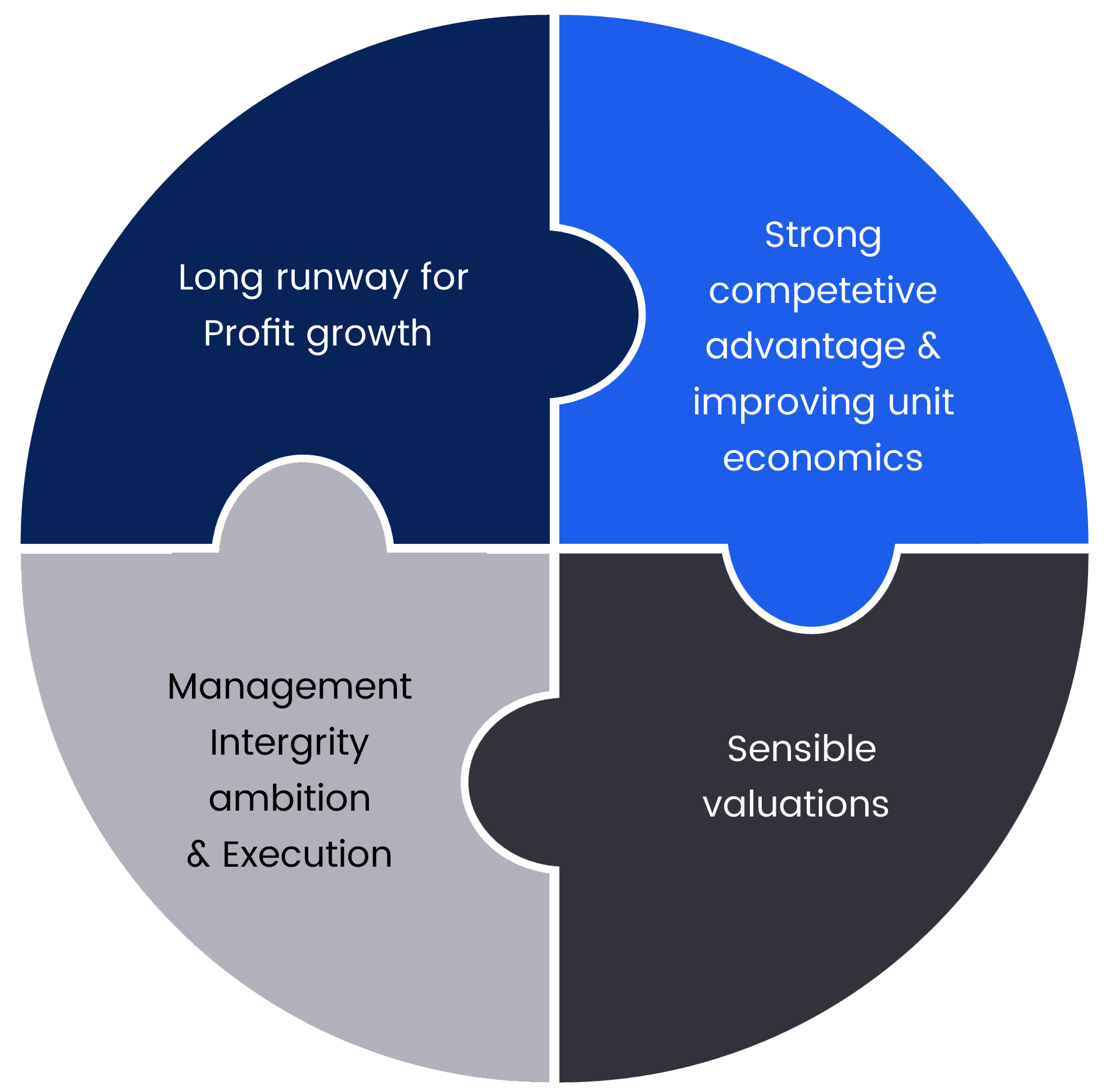

Backing exceptional management teams that are running businesses with a sustainable competitive advantage and addressing large opportunities, at sensible valuations has historically been a recipe for generating exceptional returns.

Our latest study titled “Non-linear outcomes” suggest that small caps and mid caps offer the highest potential for exceptional returns. Three key insights from our study:

- Companies that delivered >10X returns achieved an impressive profit CAGR of 22.5% as a group, significantly outpacing the -2.5% to 14.5% CAGR for others.

- RoE improved by 128 bps for >10X return companies, compared to RoE contraction of 232-867 bps in others.

- Earnings growth accounted for 73% of the returns generated by companies that delivered >10X while multiple re-rating contributed the remaining 27%.