Rigorous Process

Our investment process on average takes 2-3 months of intensive research before a company enters our portfolio.

The process is summarised below

Our Research Process

Besides maintaining buy- & sell-side relationships and

tracking news/corporate actions, we leverage the Burman

family’s private business ecosystem to gain an edge on

understanding business fundamentals vs general market

participants.

Our proprietary screening process is based on a 4-pillar

framework which enables us to filter out companies with

strong scalability potential and improving fundamentals.

Along with rigorous analysis of available public

disclosures, peer benchmarking exercises and financial

modelling, we also have a detailed corporate governance

& creative accounting checklist to uncover any accounting

shenanigans or integrity challenges.

We leverage our proprietary QuadLens framework to receive holistic feedback on the company from an exhaustive list of value chain participants.

We focus only on the truly great companies and maintain

a concentrated portfolio to achieve disproportionate

outcomes.

Besides maintaining buy- & sell-side relationships and

tracking news/corporate actions, we leverage the Burman

family’s private business ecosystem to gain an edge on

understanding business fundamentals vs general market

participants.

Our proprietary screening process is based on a 4-pillar

framework which enables us to filter out companies with

strong scalability potential and improving fundamentals.

Along with rigorous analysis of available public

disclosures, peer benchmarking exercises and financial

modelling, we also have a detailed corporate governance

& creative accounting checklist to uncover any accounting

shenanigans or integrity challenges.

We leverage our proprietary QuadLens framework to receive holistic feedback on the company from an exhaustive list of value chain participants.

We focus only on the truly great companies and maintain

a concentrated portfolio to achieve disproportionate

outcomes.

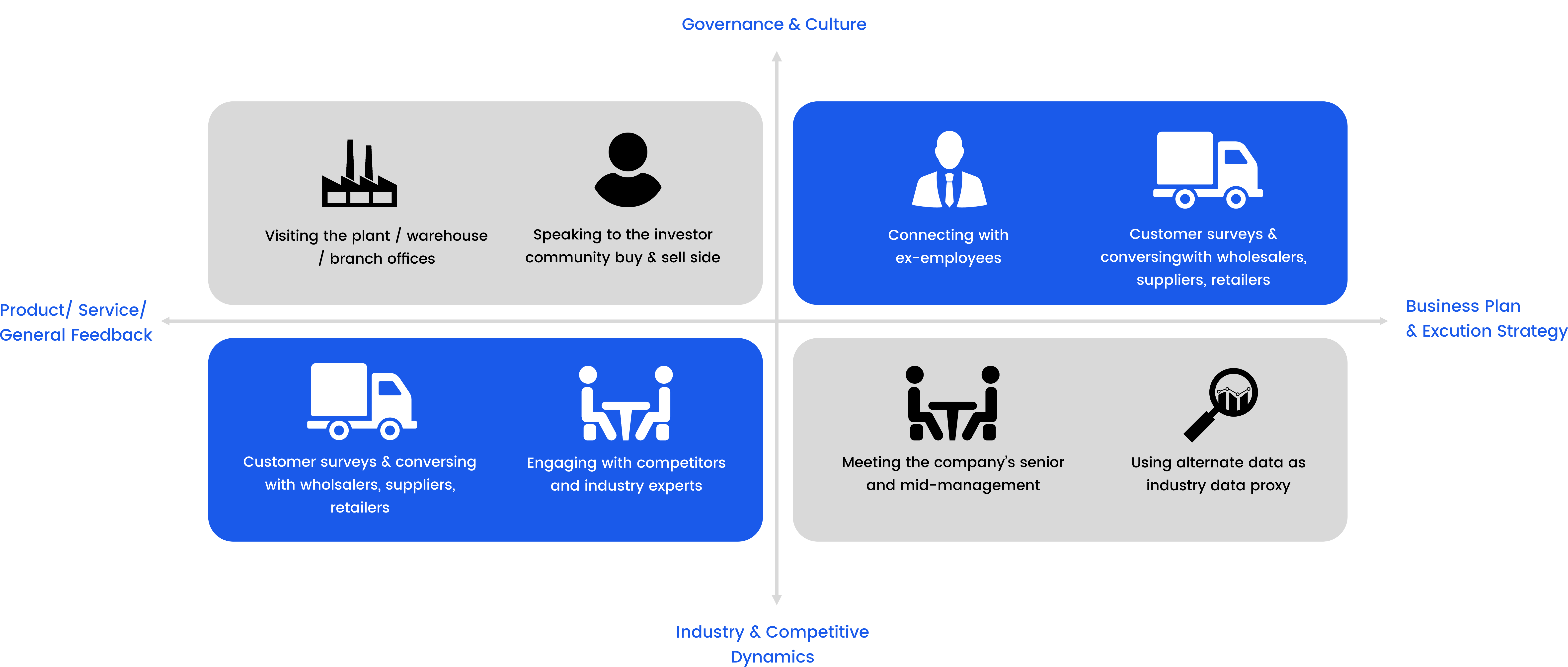

Pre-Investment: QuadLens Diligence Model

In order to verify our investment thesis, we conduct a rigorous due-diligence exercise. We do this by looking at

businesses from 4 different lens covering aspects like business plan, governance, industry dynamics and

company’s product/service feedback. Our proprietary QuadLens Diligence model enables us to generate

valuable, lesser-known insights about the business providing us an information alpha in the market.

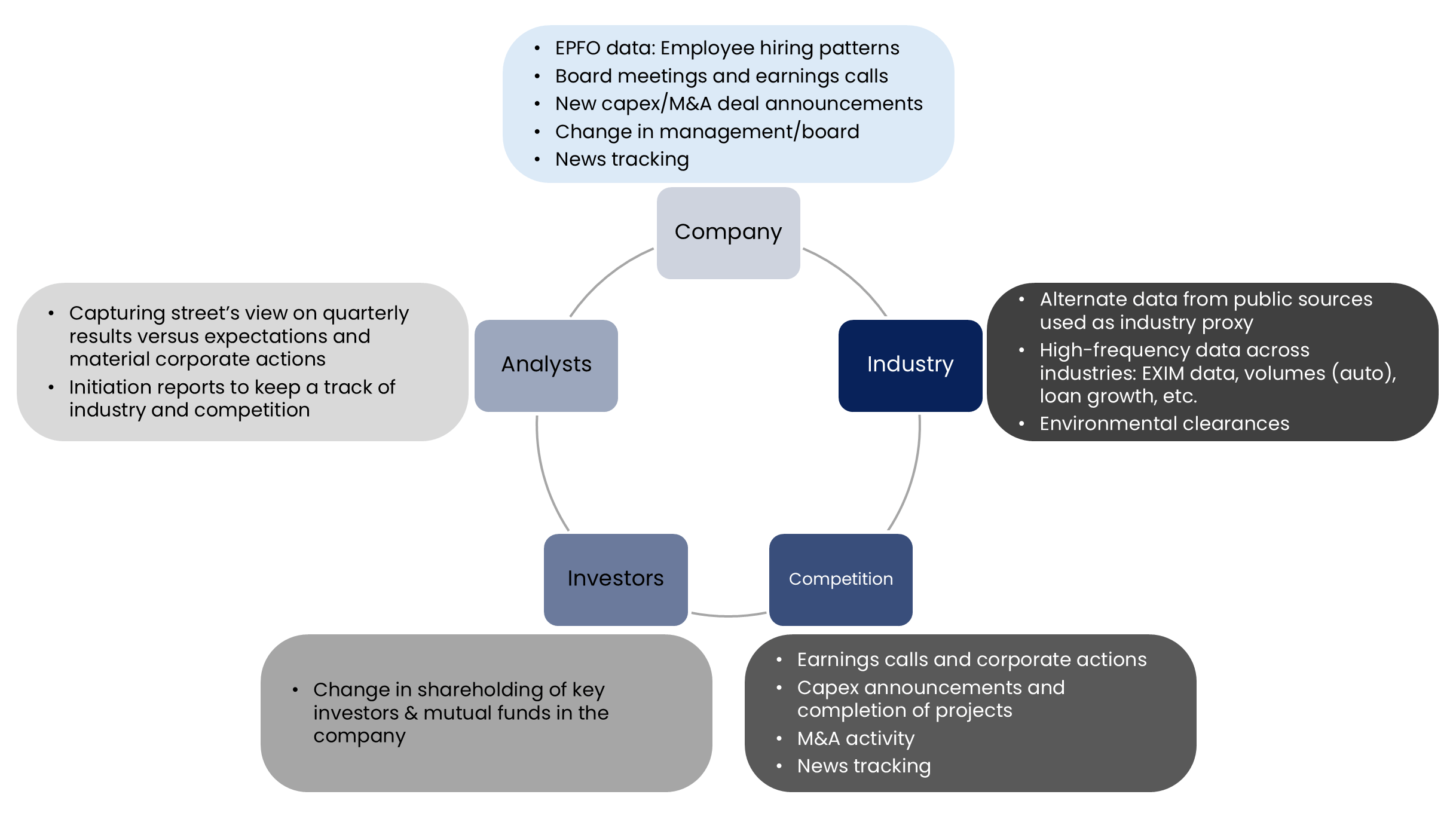

Post-investment

Once invested, we track our companies like a hawk leveraging a multitude of publicly available data under 5 key verticals:

Company-specific disclosure and high-frequency data, industry, competition, investors and sell-side analysts.