Rooted in legacy.

Built to last.

Invest with us and be a part of the growth journey of India’s undiscovered champions. Backed by a proven track record and a rigorous investment process, we are dedicated to delivering long-term value to our investors.

WHO WE ARE

We are part of Burman Family Holdings, the strategic investment platform of the Burman family, the promoters of Dabur Ltd.

SEBI-registered Portfolio Manager with registration number INP100007091.

Investment advisor to an offshore fund structure based

out of Mauritius.

Our Track Record

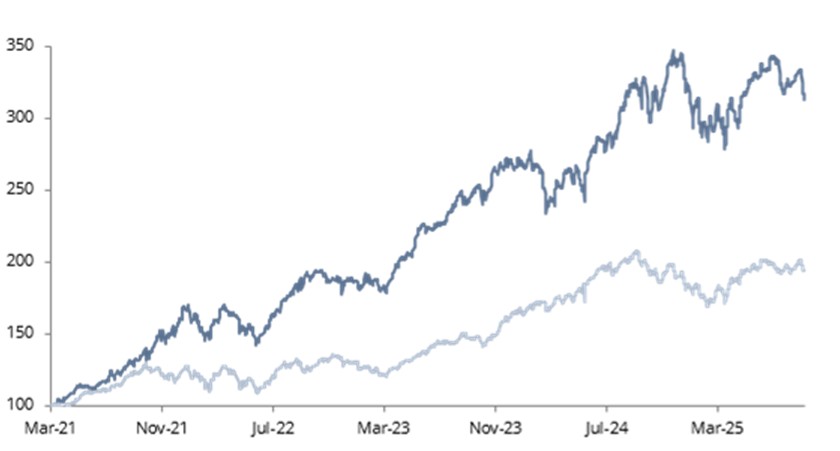

Rs 100 invested in our portfolio in Mar-21 would have become Rs 313 in Aug-25 vs Rs 195 in our benchmark

Unicorn Portfolio

BSE 500 TRI

- Delivered 28.7% annualized returns since inception vs 15.6% for benchmark

Focused on investments

providing potential for non-linear outcomes

Investment process centered on

rigorous due diligence

Concentrated portfolio of up to

15 small-cap/mid-cap stocks

Our People

Driven by Passion, Powered by Expertise

At Burman Capital, our team is the driving force behind our success. We are a group of seasoned professionals who bring together decades of expertise in investment management, research, and operations. With a shared vision and unwavering passion, we aim to identify opportunities that create long-term value for our clients.